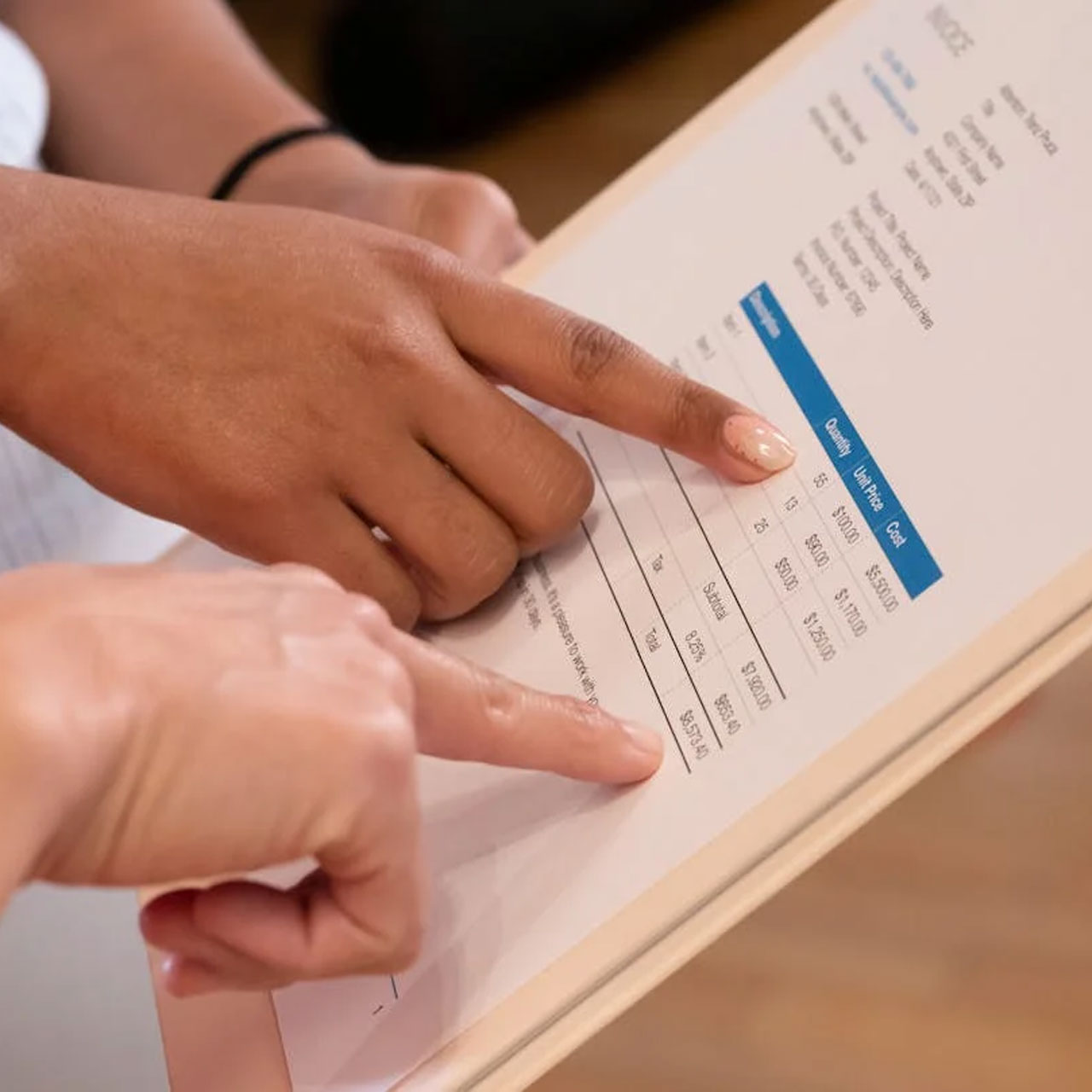

Payroll & Invoicing

Manual payroll

Automated payroll

International payroll

Temporary / permanent contract payroll

Weekly and monthly payroll

Calculating overtime, bonuses and commissions

Cash allocations

DBS deductions

Client-Centric Approach

Above all, our clients and their candidates come first, and their needs and feedback influence each decision we make.

Record-Keeping

Payroll records that are precise and well-organised are necessary for compliance, auditing, and dispute resolution. Companies must keep thorough records of all earnings, taxes, and deducted amounts for overpayments or underpayments.

Overtime and Holiday Pays

We take extra care when calculating annual leave, bank holiday payments, sleepovers, sick leave, shadow shifts, and overtime pay to guarantee compliance with client and umbrella company / internal rules.

Payroll Software and Systems

Streamlining procedures, minimising errors, and guaranteeing regulatory compliance can all be achieved by using payroll software or outsourcing payroll to a reputable company. Sage, Quickbooks and Xero accounting softwares, as well as other recruitment tools like Eclipse recruitment and Itris software are areas of expertise of our staff.

Communication

Open and honest communication with our clients regarding payroll procedures, guidelines, and changes promotes trust and openness inside the company. We make sure that the management team, consultants, payroll, and compliance all communicate fairly and effectively. In addition to assisting with payroll-related matters, we also make sure that we stay in touch contact with your team and the payroll provider to offer input on the services rendered and to resolve any issues or recommendations for enhancement.

Streamlining Operations

We provide contract-based process streamlining assistance.